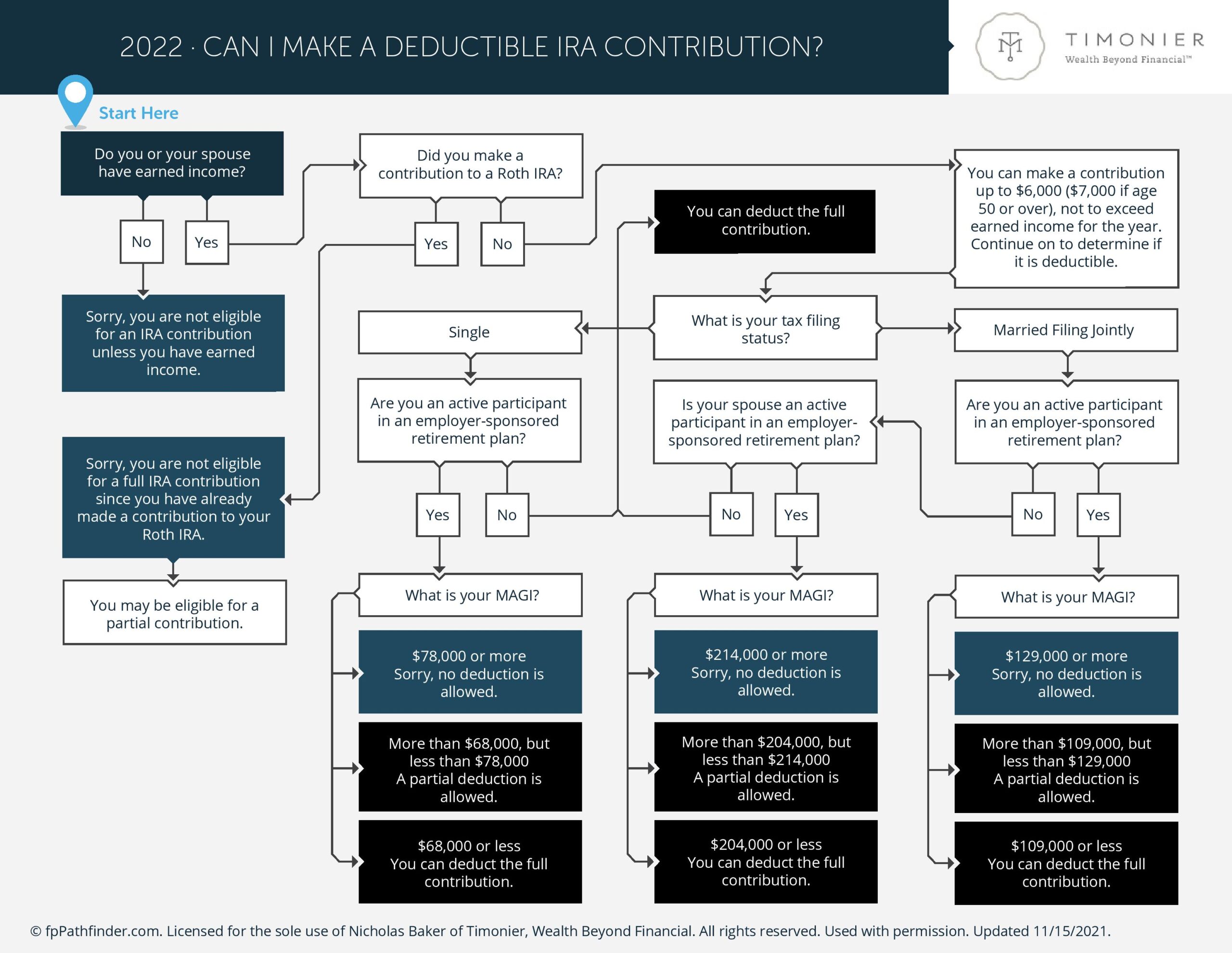

Sometimes A Traditional IRA Contribution is NOT Tax Deductible

A traditional IRA is a great option for clients looking to save for retirement in a tax-deferred account. However, there are many factors to consider when determining whether a client is eligible to make contributions, and whether such contributions will be deductible or not.

To help make the analysis easier, we have created the ”Can I Make A Deductible IRA Contribution?” flowchart. It addresses common factors affecting eligibility rules for traditional IRAs, including:

- Earned income

- Coverage under an employer plan

- Other (Roth) IRA contributions

- Filing status-based MAGI thresholds

Updated for 11/15/2021